When President Trump abruptly announced 25 percent tariffs on Canada and Mexico on Feb. 1, a WhatsApp group for Canadian beauty startup founders sprung into action.

Within two days, they had formed the Shop Canadian Indie Beauty Collective, a website listing domestic offerings from sustainable body-care brand Everist, clean skincare label Graydon and Ayurvedic skincare collection Sahajan. The 20 brand founder members listing their labels on the site contributed funds to set up the collectiveâs website and hired a publicist to promote it within Canada.

âIt happened with lightning speed,â said Lisa Mattam, the founder and CEO of Sahajan and a member of the collective. âIt speaks to that Canadian hustle.â

Trumpâs stated reason for the tariffs is an âextraordinary threat posed by illegal aliens and drugs,â but founders, retailers and investors are concerned about the potential of the tariffs to force them to choose between denting margins or raising prices when consumers are already concerned about inflation. Before the tariffs took hold on Tuesday, the nationâs homegrown beauty brands, who are heavily dependent on US exports, have been scrambling to send products to US warehouses. Grappling with the long-term implications of Canadaâs role as an export-led startup hub, theyâve also joined influencers and retailers getting on board with âBuy Canadianâ social posts and ads.

âThe reaction of Canadians has been so aggressive,â said Jenn Harper, the founder and CEO of Canada-based Cheekbone Beauty, which has been posting Instagram content highlighting the fact that it is the only Indigenous-owned Canadian colour cosmetics brand at Sephora Canada, and resharing influencersâ Canadian beauty brand roundups. Sephora Canada itself has seen its Instagram comments fill with consumers asking for a curated list of Canadian brands to shop.

âIâve never seen anything like it,â Harper added.

A Global Beauty Capital

The launch base for global powerhouse brands like MAC Cosmetics, Deciem, and Ilia Beauty, Canada has long been a thriving global beauty startup capital. For new beauty brands, export to the US has been a given, and is often baked into their business models from the beginning.

âWeâre already international on day one. We have to control digital spend in two geographies out of the gates,â said Manica Blain, the founder of VC firm Top Knot Ventures, which invests in consumer DTC brands including Sahajan and Everist. This two-market mindset makes Canadian founders âincredibly scrappy,â Blain said.

The bulk of Sahajanâs sales, for one example, are split nearly 50-50 between Canada and the US, with only 2 percent coming from outside those two countries.

âItâs incredibly important to go to the US quickly,â said Mattam. Beyond the size of the market, the US is crucial for recognition by US-based press and influencers. That international positioning â also seen in global beauty startup capitals like Seoul â is what helps make Canada a âhub for innovation,â said Mattam.

Smaller indie brands with Canada-exclusive manufacturing will not be able to shift operations as quickly as major global conglomerates, say founders and investors. The extent of the impact is still to be determined, as questions like whether a de minimis exemption allowing tax-free orders up to $800 â which was briefly suspended, then reinstated for China (with a note that it will still eventually go into effect) â would apply to Canadian goods, or if tariffs would be applied to the wholesale or retail cost of goods, which has significant implications for margins. On Tuesday, the Trump administrationâs executive order on Canada tariffs said that the de minimis exemption will end once âadequate systems are in placeâ to collect payment.

The impact wouldnât be limited to Canadian brands selling in the US, as Canadaâs announced retaliatory tariffs combined with consumer boycotts could dent US brandsâ performance in Canada. That market has been a big opportunity for expansion in recent years â Canada reportedly contributed $2 billion out of Sephoraâs $10 billion in North America revenue in 2023, according to industry sources. Sephora did not provide a confirmation.

Beauty Patriotism

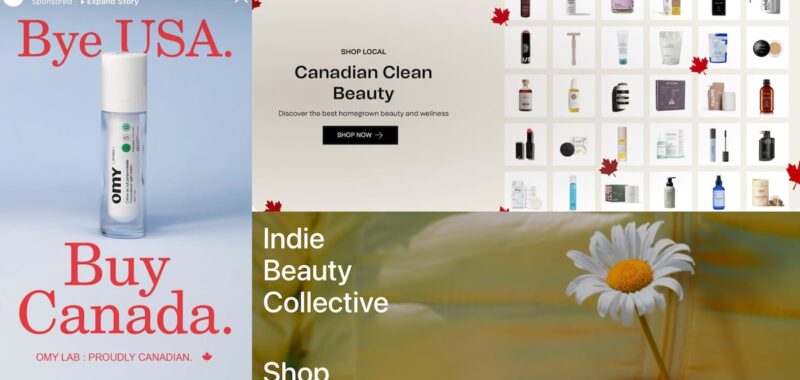

In response to the tariffs, the beauty industry has been tapping into âBuy Canadianâ pride.

Sahajan, for example, has created several ads and social posts highlighting that it is a Canadian brand. One ad features the Canadian flag alongside founder Mattam stating, âIt has never been more important to shop Canadian.â The cosmetics brand Nudestix, meanwhile, has been posting lists of Canadian beauty, fashion and home brands on its Instagram account and encouraging its audience to shop them.

âThere is an interesting opportunity for Canadian brands to put up their hand, maybe louder than they ever had before, and say, âweâre Canadian,ââ said Mattam.

Retailers have also gotten on board. The Detox Marketâs Canadian homepage opens to a âCanadian clean beautyâ banner linking to a curation of brands including body care brand Sidia, clean skincare label Three Ships and more.

But founders also want to ensure the US customer is not alienated. To keep prices steady, they have scrambled to move their products into US-based third-party warehouses before the tariffs take effect. âThe last thing that you want to do is be hitting your customer with that huge price increase,â said Blain. Sahajan, for example, moved an estimated three months worth of product to the US in anticipation of tariffs.

These are short-term solutions, while the long term remains unclear. Canadian founders cast doubt on the idea that tariffs will spur a US-led manufacturing boom â a pipe dream when it comes to beauty.

âYouâd be reverse-engineering a product and starting over,â said Sasha Plavsic, the founder of Ilia Beauty, which has some manufacturing in Canada along with multiple global locations including the US and Europe. The two-year average for product development, she pointed out, âis a very long process, and by that time, the trade war could be over.â

Even if these tensions cool in the coming months, the conversation has already shifted foundersâ and investorsâ mindsets in Canada when it comes to where to look for growth. Rather than focusing squarely on the US at launch, founders say they are likely to start looking at expansion to other markets more quickly from now on.

If tariffs remain at 25 percent, Canadaâs startup scene is in for a rough year.

âThis will kill small businesses, absolutely, 100 percent,â said Harper of Cheekbone Beauty. âThis is doing nothing for the economy. It is just creating more inflation and making all of our goods, no matter who we are â in Canada or the US â just cost more.â

Update: This article was updated on Mar. 4, 2025 to include new tariff policy details announced by Canada and the US on the de minimis exemption and retaliatory tariffs. It also clarified that Cheekbone Beauty is the only Indigenous-owned makeup brand at Sephora Canada.