Opens in new window

Opens in new windowAfter years of struggling to parley its fashion authority into topline growth, Prada Group reported its best-ever year in business in 2022. Since then, itâs continued to outperform rivals, reporting surging sales even as the broader luxury market slowed, entering a downturn in 2024.

Miu Miu, which has powered much of the groupâs recent growth, roughly doubled its sales throughout most of last year with a retooled offering of subversive yet wearable designs that have succeeded in engaging a broad sisterhood of shoppers, spanning ages and nationalities.

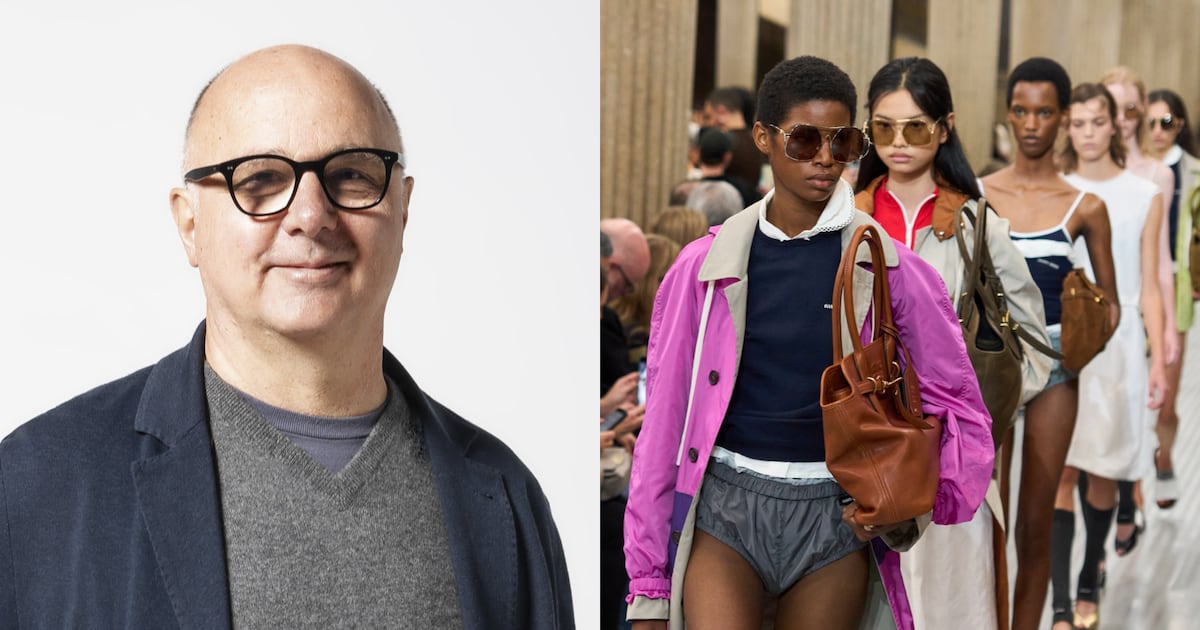

The brand is staying in the spotlight with fashion shows that continue to spark conversation online, as well as cultural activations like literary talks, pop-up bookshops and a multi-layered art installation that served as the backdrop for its latest runway and a series of performances during Art Basel Paris. âWe believe working on the cultural aspects of society is essential for our two brands to survive in the long term,â the groupâs CEO Andrea Guerra says.

The groupâs flagship Prada brand has also continued to grow, although at a more moderate pace, at a time when rival luxury giants LVMH and Kering are reporting slipping sales. The brand has raised prices â dramatically in some cases â but has yet to be punished by customers, who continue to splash out on both seasonal items and bestsellers like its Galleria tote bag and nylon rucksacks.

Guerra â who previously led Luxottica, Eataly and LVMHâs hospitality division â is Prada Groupâs first chief executive from outside its founding family. Heâs piloted the Milanese fashion empire since 2023 as it seeks to make progress on its succession plans and keep outperforming competitors in a rocky luxury market.

BoF: Miu Miu continued to report spectacular performance throughout 2024, even as the industry slowed overall. How can you explain this success?

Andrea Guerra: Miu Miu has always been very respected and very credible. But for a few years the business strayed a bit too far from the brand. Everything on the runway and in the branding was still very precise, but this wasnât always represented in the products, in stores. Since around three years ago weâve put everything back in line, and this is the success story.

Itâs also about hitting something specific in society, linking your brand and products and identity to what consumers are looking for.

BoF: A lot of customers are certainly responding to that clear, creative identity at Miu Miu â is that a big part of why itâs been such an outlier? Does luxury have a creativity problem?

AG: The industry is at a turning point: you have turmoil in creativity, turmoil in companiesâ leadership, and for the first time in years, you have some negative numbers like the industry has never seen.

The brands with positive [growth] in 2024 all have a long-term view on creativity, design, communication and management. And a strong link between the creativity, the image and the company. This is one of the most important âpositive tensionsâ you need in this industry â and which you donât necessarily see in all brands today.

BoF: Going into 2025, how are you thinking about solidifying and supporting Miu Miuâs business after such rapid growth?

AG: Firstly, weâre not talking about great-huge absolute numbers. So itâs easier to imagine how weâve been doing plus 50 [percent] or doubling.

Next weâll add degrees of masochism: analysing whatever weak signals come from the market, competing with ourselves even more. For our branding and creativity, weâll do the same, but always more credible, more impactful. Itâs about doing things which are a bit bigger, but not necessarily louder.

What we did with our runway show and during Art Basel Paris gives you an idea of how strong Miu Miuâs cultural roots are in art and cinema. This installation â a collaboration between the brand, Mrs Prada and Polish artist [Goshka Macuga] â was one of the most-seen events in Paris that week. We never just put a label or tag on an event. Either we are part of something or we donât do it.

Itâs like with Luna Rossa of Prada [the Italian sailing team for the Americaâs Cup]. Itâs our team. Or we could talk about the Fondazione Prada â itâs our museum.

BoF: So those are deep engagements, even if rather varied. Is this what you meant in your most recent earnings call, when you talked about building âpolyhedric brand equityâ?

AG: We believe working on the cultural aspects of society is essential for our two brands to survive in the long term. We are carving culture, carving society. If you look at our stores, theyâre really an open door to understand where architecture is going, where art is going, where engineering is going. Thatâs what the world of Prada represents.

The Prada brand is credible from sports, to culture, to the arts â these aspects that can reach very different typologies of consumers and attitudes. We are as relevant as a lifestyle brand as we are for a glamorous night. So Prada is naturally âpolyhedricâ [many-sided]: itâs a living element that is able to address and live in very different parts of your life. Not many brands are capable of that

BoF: Those activities youâre speaking about in art, architecture, sports are so closely tied to Mrs Prada and Mr Bertelliâs interests, in a very personal way. Youâve been brought in to help guide the companyâs succession. How do you think about scaling up and taking forward these cultural messages within the framework of a succession plan?

AG: We are on a long journey. Our two founders are still very young in spirit. They work seven days a week, thinking about the future of their brands in terms of decades.

Itâs very unusual for an Italian company to lay out a plan for generational transition, where the family is saying: we will remain independent, Lorenzo [Bertelli, son of Patrizio Bertelli and Miuccia Prada] is the boss, Lorenzo is the person who will manage this in the long term, and itâs clear for everyone.

If you look from 50 kilometres above, the journey looks like a Californian highway, huge and open. If you come closer, sometimes it seems more like a mountain road.

BoF: Looking at the Prada brand, I know thereâs been a big focus the past few years on retail execution. Tell us about that.

AG: Stores are a tool for something that has completely changed in the last six, seven years at Prada, which is our relationship with the Prada consumer or potential consumers. We have always been a very brand-orientated, image-orientated, product-orientated company, but not necessarily the best in customer relationships.

We are placing a lot of importance on the experience in stores because they are the epicentre of that relationship. People donât just want a tag, people want to live inside a brand. They want to know what we think, how we behave, to get excited with us. They want to have experiences that make the Prada brand alive. That is what we have been focusing on.

BoF: How do you filter this approach throughout the culture of an organisation as big as Prada Group?

AG: This is another long-term journey. Itâs about training your own people â allowing them to understand that this is an opportunity to evolve â along with inserting some people from outside [the company] who know how to do these things from a master point of view.

BoF: Brands across the luxury sector are dealing with weak consumer sentiment in key economies and the lingering impact of inflation. What else has been driving luxuryâs downturn? Do you see it as mainly coming from cyclical, macro-economic pressures or is there something deeper at play?

AG: There are a couple of very specific challenges, the first being China. We believe in the long-term [potential] of Chinese consumers and China â strongly â but 2024 and I think part of 2025 will not be easy in that part of the world.

Thereâs also a cycle thatâs more specific [to luxury]. Many companies have been changing their creative directors, their CEOs, as there is a shift and turning point.

The sector has probably been a bit spoilt by leather goods. Leather goods have increased in volume, increased in prices, and are an easier business than ready-to-wear or footwear â there is no sizing. In certain cases, there has been hyperinflation [in handbag pricing] which was not linked to the value of the dream you were giving consumers. On the other side, maybe the consumer said, âI have too many bags in my closet. Maybe Iâm going to have a cruise; Iâm going to have a holiday in a hyper luxury hotel.’ But I still think thatâs cyclical, and that the sector by definition will continue to grow.

BoF: Whatâs been driving this hyperinflation in prices? What can brands do about it now?

AG: Prices havenât just gone up in a useless manner. There are segments of the market where the products, dreams, experiences really allowed for higher prices. But some brands who increased prices, who abandoned their aspirational customers, probably should have remained more calm.

There is only one real solution, which is allowing your brands to make people dream, having products which are credible, and granting experiences to your consumers that are totally unique.

The most important thing at whatever price youâre selling is not to betray your core consumers. They always need to find your world comfortable for them.

BoF: What does this shift to spending on experiences mean for luxury?

AG: We are seeing, especially since Covid, an explosion in that experiential luxury world. Hotels, cruises, food. Whatâs good about that is itâs still part of the luxury industry â getting larger and with stronger assets and stronger pillars.

Borders are blurring; walls are coming down. So weâre all competing â on heart shares, on pocket or wallet shares. Shall I spend thousands of dollars on a vacation or on a product? Can we put certain things together? There are bits and pieces of hospitality coming into personal products, and vice-versa. I think that will be the fun part of the next 10 years.

BoF: So you see China remaining complicated into next year. How do you expect luxury demand to evolve more generally?

AG: 2025 will be, at least for the first six months, a tough year, as the last 12 to 15 months have been. Demand is still there; people are still wishing and dreaming about luxury. At Prada, weâll need to do an even better job in order to keep growing over the industry average and gaining back the market share I think we deserve.

BoF: Prada Group, Zegna and Brunello Cucinelli have all outperformed the market in recent quarters. But competing for market share is historically tough for independent companies. How can you keep up with conglomerates like LVMH in the long term?

AG: Itâs tough to work in an industry where there are such powerful, wealthy giants. We need to have very good ideas. We need to be quicker. We need to be different. We need to have a closer relationship with our counterparts so we can maybe understand before others how to deal with communication, real estate, landlords. We have to do things more simply and more quickly, to be a little more clever.

BoF: Youâre still very optimistic about the industryâs potential. Why?

AG: Our brands really are here to allow people to dream. So this is what we have to do. The more we can dream, the more weâre linked to society and culture, the more we can allow our next generation [of customers] to dream with us.

This interview has been edited and condensed.

This article first appeared in The State of Fashion: Luxury, an in-depth report on the global luxury industry, co-published by BoF and McKinsey & Company.